Don't put money in the bank, own the bank!

On the way home from work I was chatting to a colleague about money, and remembered a phrase I heard a while ago: "Don't put money in the bank, own the bank!"

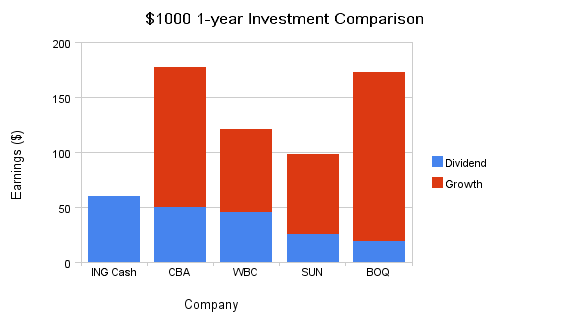

While I can't recall the exact place I heard it (although I've found at least one site that looks at the concept), I thought it was at least quickly looking into it. I compared putting money in a ING Direct "Savings Maximiser" account to buying stocks in four major Australian Banks: Commonwealth, Westpac, Suncorp, and Bank of Queensland.

The amount invested was $1000; I've taken into account capital growth and dividends; and the time frame of the comparison was 1 year ending today. The current interest rate of the ING Direct account is 6% pa.

It should be noted that in the time period shown, Commonwealth and Westpac paid two dividends whereas Suncorp and Bank of Queensland only paid one.

The comparison shows that even the poorest performing investment, Suncorp-Metway, still earnt $38 more than a cash account - that's an effective interest rate of 10%!

Now, I'm not a financial adviser, nor am I any sort of economist or analyst, so take what I say with a grain of salt. I also didn't take into account brokerage fees, nor did I account for the tax benefits of the dividends being fully-franked. Investing is also carries a higher risk, so you could possibly lose every cent you invest.

Nonetheless, What does this mean?

It's more effective to own the bank!

blog comments powered by Disqus